The Aotearoa New Zealand

Open Banking Ecosystem Map and Report

1st Edition - November 2024

In collaboration with

Proudly supported by

Download the Ecosystem Map and Report

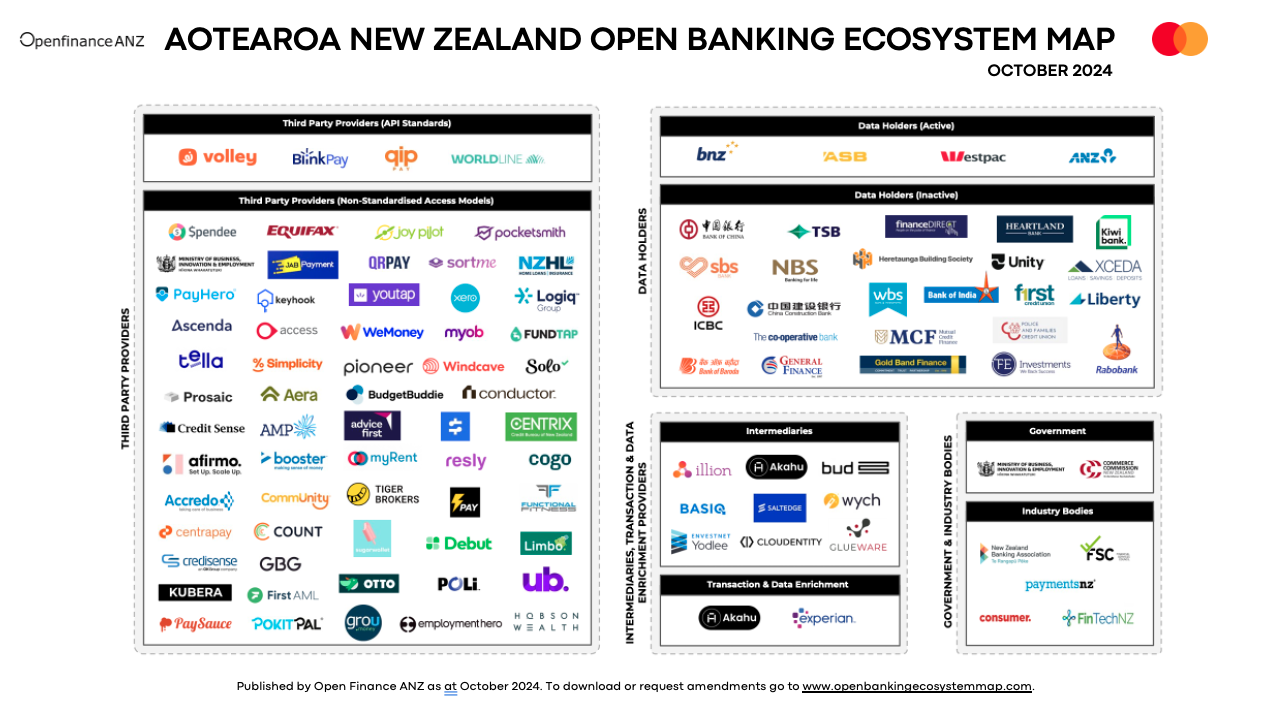

If you want to understand who is participating in the New Zealand Open Banking Ecosystem and the latest trends, download the comprehensive ecosystem map updated as at 4 October 2024.

Quick Ecosystem Facts

at November 2024

?

60

Active Data Holders (API Centre)

Consumer Bank Account Coverage

Third Party Providers (other access models)

Number of consumers using open banking

Over 80%

4

4

Third Party Providers (API Standards)

— Jason Leong, CEO and Founder, Pocketsmith

Personal financial data is difficult to access and interpret, preventing many Kiwis from gaining meaningful insights and making informed decisions. This financial exclusion has existed in broad daylight for decades, and it is time for change.

Open banking unlocks a future where financial empowerment is for all New Zealanders. Knowing facts about your money should be as simple as knowing the time, and the CDR will enable the innovation to make this a reality.

As we continue the rollout, it is crucial that stakeholders maintain a strong focus on consumer outcomes, ensuring that data quality and reliability remain central to success. By prioritising these factors, we can build a robust ecosystem where users can trust and benefit from the transformative potential of open banking, driving lasting positive change for all.

Key Takeaways

The Aotearoa ecosystem is already active

There is already an active open banking ecosystem in Aotearoa, with Third Party Providers (Non-Standardised Access Models) comprising the largest cohort (58%). Growth in the use of API Standards will occur following passage of the CPD Bill.

Early adoption driven by smaller players

The number of smaller industry players present in the ecosystem highlights the importance of creating a sustainable ecosystem for participants of all sizes.

Financial services & Fintechs the focus

Unsurprisingly, members of the financial services and technology services industries are the most prevalent users. We would expect to see increased growth in other industry sectors as regulation takes effect and more participants enter the market.

Payments leading the way, but common data use cases close behind

Payments use cases are typical drivers of early consumer uptake- this experience is common to open banking ecosystems elsewhere, including notably in the UK. There is an opportunity for uptake of high-value data driven use cases such as lending, accounting and money management to increase.

Diverse data access methods used

Aotearoa current open banking ecosystem comprises a diverse mix of data access models. We expect consumers and businesses to transition towards increased use of API Standards. A number of the ecosystem also use multiple access models.

Intermediaries play a key role

As is the case in Australia and other open banking ecosystems, specialist intermediaries play a critical role in facilitating connectivity, aggregation and data enrichment services for the benefit of participants.

— Jane-Renee Retimana – Chief Strategy & Innovation Officer, Payments NZ

2024 marks a significant leap forward for open banking in Aotearoa. The four largest banks will be implementing two API standards for Payments Initiation and Account Information throughout the year. This development will promote secure, user-friendly data sharing, paving the way for a new wave of fintech innovation that will greatly benefit consumers and businesses alike.

We are particularly excited to announce the creation of the Aotearoa New Zealand Open Banking Ecosystem Map & Report. This initiative will provide a comprehensive overview of the key players and participants in our local open banking landscape, offering valuable insights into the roles, innovations, and opportunities emerging within our market. While we see the value in collaborating with Australia, this map will focus solely on Aotearoa, reflecting our unique ecosystem and setting the stage for customer-centric open banking solutions that cater directly to consumers and businesses across Aotearoa.

No registration required.

Download the Aotearoa New Zealand Open Banking Report

Looking to get added to the Ecosystem Map?

Whilst we endeavour to collect information on all participants during our research, we might miss participants from time to time. If you would like to request an addition or amendment to the Open Banking Ecosystem Map please fill out the form below.